What do you mean I cant deduct my property taxes No you can not if its a flip property Cant deduct your property taxes What about my interest. You can also deduct for travel and vehicle expenses as you drive to and from the property to and from settlements etc.

Your fix up expenses are still NOT DEDUCTIBLE until you sell the house.

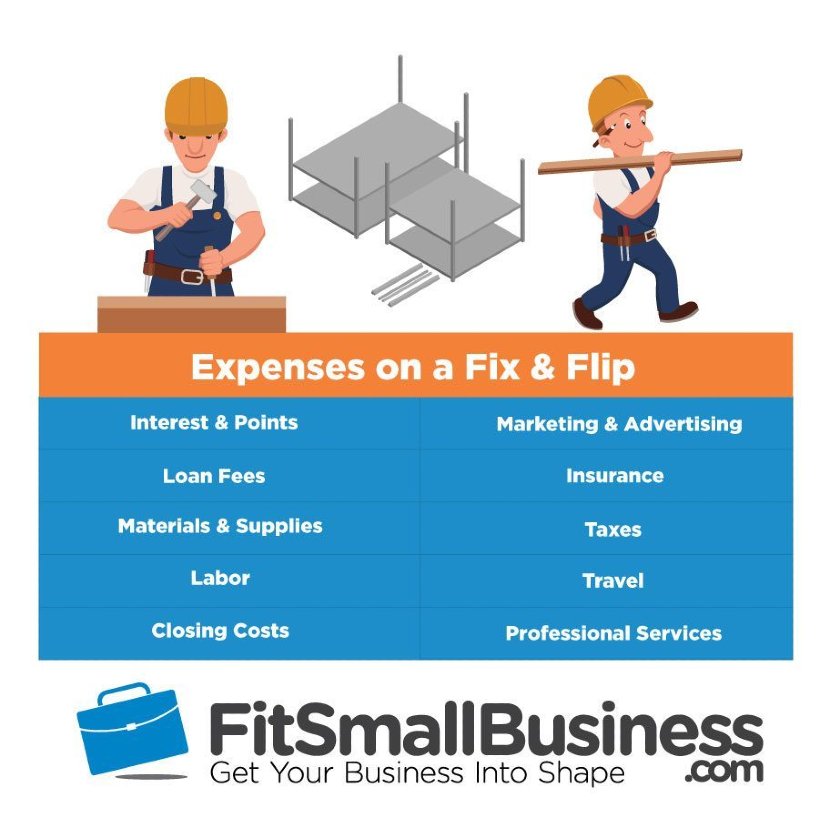

What expenses can i deduct when flipping a house. You can typically deduct the cost of repairs including labor costs from your earnings for an investment property but you cannot typically take an immediate full deduction for the cost of. You can also elect to capitalize these costs if you wish. These are deducted after you flip the property.

Vehicle expenses which can include gas and repairs or a standard mileage rate. Remember home flippers are classified as dealers as businesses. Also learn important distinctions including assets vs inventory.

Im paying interest on this thing Sorry all your expenses associated with that property until such time as you get to the point where you either sell it or you can rent it to a rental theyre all going to be capitalized. If you sell flip one house and quit. If you flip a house for investment purposes you can deduct the purchase and repair costs from your profits for capital gains tax purposes.

Vehicle Expenses Flippers usually spend a ton of money on gas when scoping out houses traveling to a property or hauling supplies. If you are not subject to Sec 263A then holding costs such as interest property tax etc. Home business travel advertising and other operational expenses can apply if you use the flipped house for business purposes.

Can I add my personal labor to the cost basis of a flipped house. In this presentation learn which expenses you can deduct when flipping a house. Capital expenditures expenses related to buying and renovating a house with the intention to flip.

UtilitiesYes Any payments made to utility companies for the property are deductible You will find a few other deductible expenses that you may not have thought about on the webpage at the following link. Simple list of tax deductable expenses when flipping a house Cost of purchase only deductable after the house is sold Cost of materials during renovation only deductable after the house is sold. Some expenses you can deduct when flipping a house include.

Your business expenses legal fees and accounting fees can also be deducted. Loan interestYes Just make sure that you can prove that these funds were used solely for your flipping business and not for personal use. Hobby income is reported on Form 1040 and expenses are deductible only up to income as miscellaneous itemized deductions subject to the 2 percent of adjusted gross income limitation.

If you have to travel as part of your house flipping project you can generally deduct the cost of mileage placed on your vehicle so long as it applies to conducting business. The taxpayers profit motive expertise time devoted to house flipping and other factors are all considered to determine if the activity is a business or hobby. But general business expenses like mileage would be deductible.

Anything else and its most likely youre in business but it depends on all the details. If you are Flipping houses can you deduct in the current year interest paid utilities insurance operating expenses. Your own labor is never tax deductible nor can it be added to the cost of an asset you own.

The TCJA suspends the miscellaneous itemized deduction for investment expenses until 2026. While investors can deduct real estate taxes and mortgage interest they cannot deduct other expenses associated with investment houses for years 2018-2025. Can be deductible when paid.

These expenses include items such as attorney or accounting fees utilities or insurance. You can deduct part of your rent or mortgage payment for your home office part of your utility bills plus any home office supplies and equipment. Travel and lodging expenses that must be performed for business operations can also be deducted.

If your house contains 1000 square feet of floor space you can deduct 10 percent of your rent or mortgage payment and utilities as office expenses.

5 Ways The Real Estate Industry Will Completely Transform Over The Next Decade Real Estate Real Estate Investing Sell Your House Fast

4 Ways To Save On Your Taxes In 2016 Morris Invest Real Estate Investing Rental Property Real Estate Investing Flipping Real Estate Buying

I Love This Strategy The Live In Flip Is The Easiest Way To Get Started Flipping Houses Best Part Liv Flipping Houses Real Estate Buying Home Buying Tips

Flipping Houses Flipping Houses Hud Homes House Renovation Plans

This Is Spreadsheet Is Set Up To Manage 10 Properties With A Different She Rental Property Management Rental Property Investment Real Estate Investing Flipping

What Should You Focus On For Investment Properties Rental Property Investment Property Investment Uk Investment Property

Your Home Office Expenses May Be Tax Deductible Home Office Expenses Tax Deductions Deduction

List Of The Expenses You Can Claim As A Tax Deduction In Australia Is You Rent Out A Commercial Rental Property Rental Property Investment Investment Property

Video What Types Of Investment Property Expenses Are Tax Deductible

The Most Common Tax Deductions For Landlords The Censtible Home Tax Deductions Being A Landlord Filing Taxes

List Of The Expenses You Can Claim As A Tax Deduction In Australia Is You Rent Out A Commercial Rental Property Rental Property Investment Investment Property

Which Maintenance Expenses Can Be Deducted On Rental Property For Tax Deduction Rental Property Vacation Home Rentals Tax Deductions

Flipping Houses Taxes Capital Gains Vs Ordinary Income

Security Deposit Deductions List What Rental Damage Could Cost Rental Property Investment Being A Landlord Real Estate Investing Rental Property

Rental Investment Property Record Keeping Spreadsheet Investment Property Investing Real Estate Investing Flipping

House Flipping Guide Marketing To Owners With Delinquent Property Taxes Flipping Houses Property Tax Property

How To Flip Houses For A Living Topics Flipping Houses Real Estate Inves Flipping Houses Real Estate Investing Real Estate Tips

Rental Property Tax Deductions And A Nice Price Break On Tax Prep Rental Property Investment Real Estate Investing Rental Property Rental Property Management

What Expenses Can I Deduct When Flipping A House

Comments

Post a Comment